The UK last entered recession in the second quarter of 2008. House prices started rapidly decreasing, with the average house price hitting a rock-bottom low of £154,452 in March 2009.

Ever since, average prices have – by and large – kept increasing. As of March 2020, the average house price in the UK stood at £233,716 – an uplift of 51% in 11 years.

Many savvy buyers will have benefited greatly from buying low and waiting for the market to recover. Even more so if the property was purchased as an investment with the intention of renting it out (often called a ‘buy-to-let’).

In such cases, owners will have benefited not just from the increase in property value, but also the rental income made from the property during the past 11 years.

Undoubtedly, property investors across the UK will be watching carefully to see how the UK’s latest recession, officially confirmed in August 2020, will impact the property market. Similar to 2008-2009, it could prove to be an unmissable opportunity for those wanting to start or expand their property portfolios.

With that in mind, we have gathered data from the HM Land Registry to look at the areas of the UK which saw the largest growth in average property prices between the first quarter of 2009, when prices were at their lowest, and the first quarter of 2020.

We’ve combined this with data on average rental yields too, so we can identify areas offering the ideal balance between capital growth and rental profitability.

The results provide an interesting look back at the UK property market over the past 10 years, but more importantly, they may help property investors to identify locations to consider for the future.

As such, this research answers two key questions:

- Where would an investor have been best off buying during the last recession?

- How can we apply the findings to future property investment decisions?

Data

The HM Land Registry maintains a database of the price paid in property transactions across England and Wales.

We exported the data for every property transaction, grouped by postcode districts (e.g. SW1), during Q1 of 2009 and Q1 of 2020.

We then calculated the percentage change in each postcode’s average price paid, showing us where prices have increased the most around the country.

Separately, we collected average rental yields for each postcode in 2020 from PropertyData, an excellent source of residential property market data in the UK.

By combining the two data sources, we were able to analyse:

- Which postcodes saw the largest capital growth, i.e. property value?

- Which postcodes, with a minimum gross rental yield of 5% in 2020, saw the largest capital growth?

Whilst the former is a strong, simple analysis of the property market, the latter may be more useful for property investors.

Gross yield is a measure of how much income a property generates each year from rent as a percentage of its value. We chose a benchmark figure of 5%, as this is typically high enough for an investor to achieve a yearly profit, whereas anything lower than 5% could mean the costs of running the property (mortgage, maintenance, etc) exceed total rental income.

Furthermore, it has been well documented that the London property market has performed well and above the level of the rest of the country since 2009. Our findings are consistent with this.

We decided to account for the “London-effect” by duplicating our data: one version included postcodes inside the City of London (those beginning with N, E, EC, SE, SW, W, WC, NW), and another version excluded those same postcodes.

This left us with four tables in total:

- Postcodes, including the City of London, ranked by capital growth

- Postcodes, excluding the City of London, ranked by capital growth

- Postcodes, including the City of London and with a minimum rental yield of 5%, ranked by capital growth

- Postcodes, excluding the City of London and with a minimum rental yield of 5%, ranked by capital growth

We chose to omit Table 4 from this report as only a single City of London postcode made it into Table 3, so the results for Tables 3 and 4 were practically the exact same.

Results

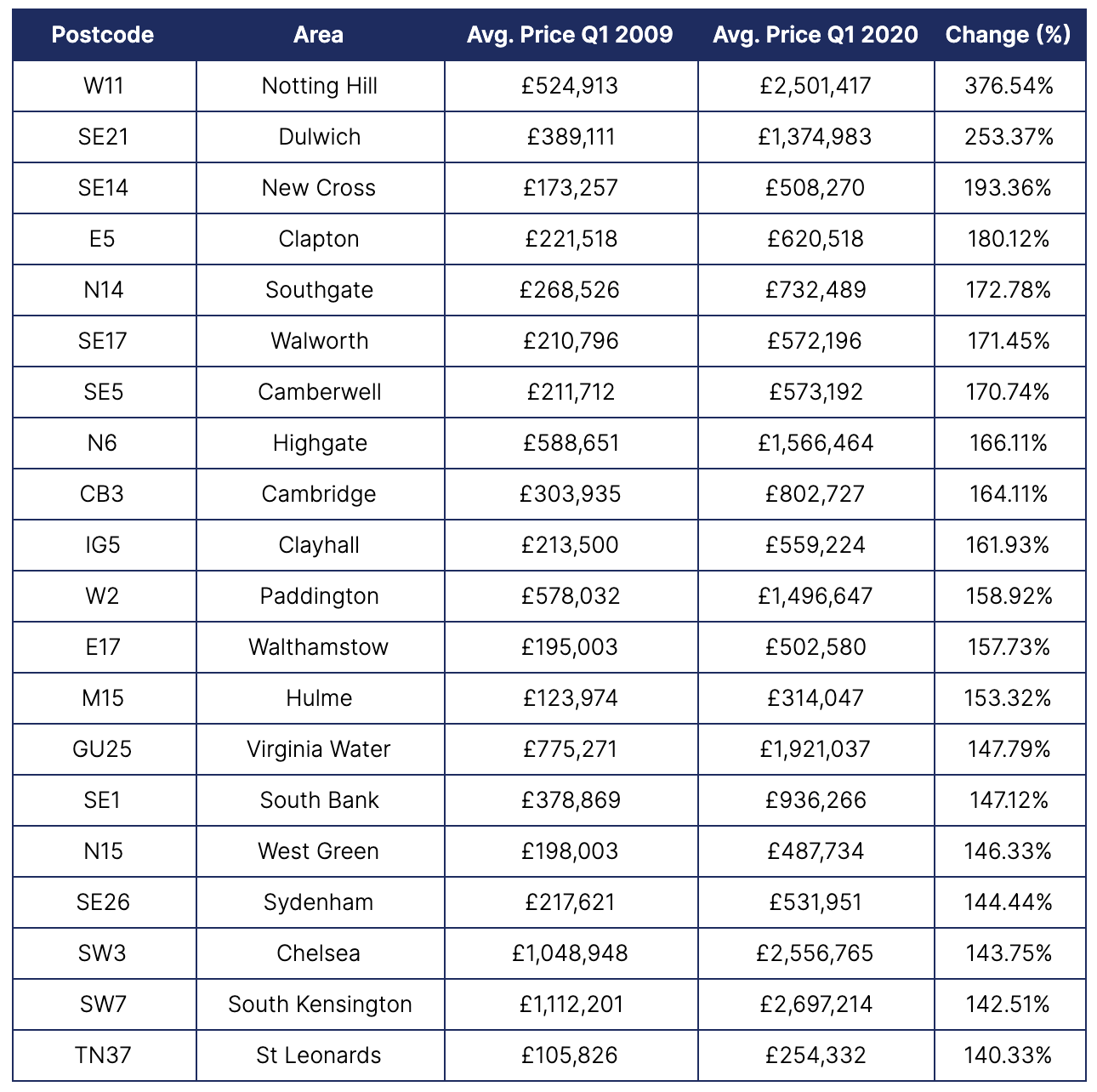

Table 1: Postcodes, including the City of London, ranked by capital growth

The top 20 postcodes ranked purely by capital growth between 2009 and 2020 are as follows:

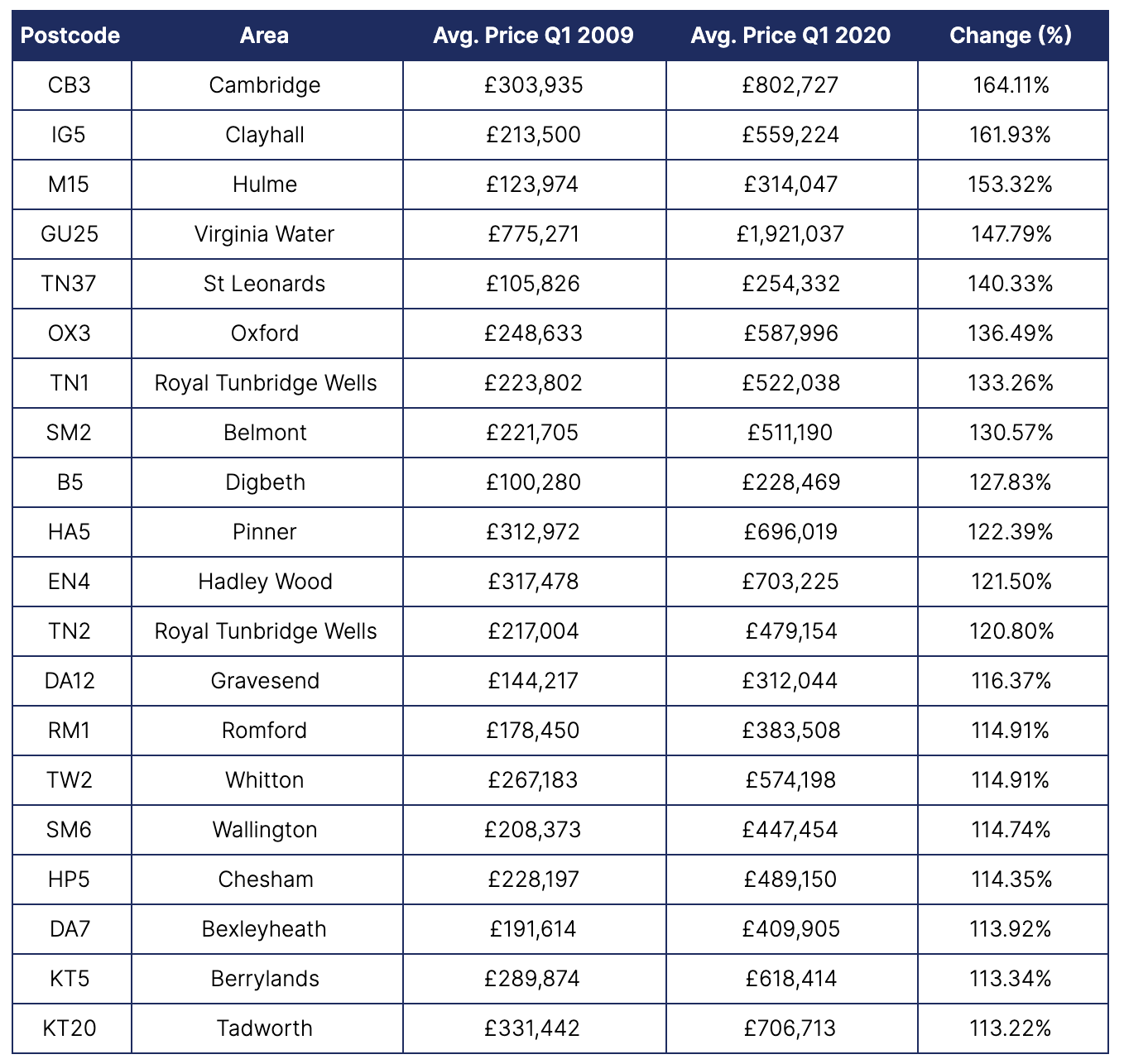

Table 2: Postcodes, excluding the City of London, ranked by capital growth

The top 20 postcodes, excluding the City of London, ranked by capital growth between 2009 and 2020 are as follows:

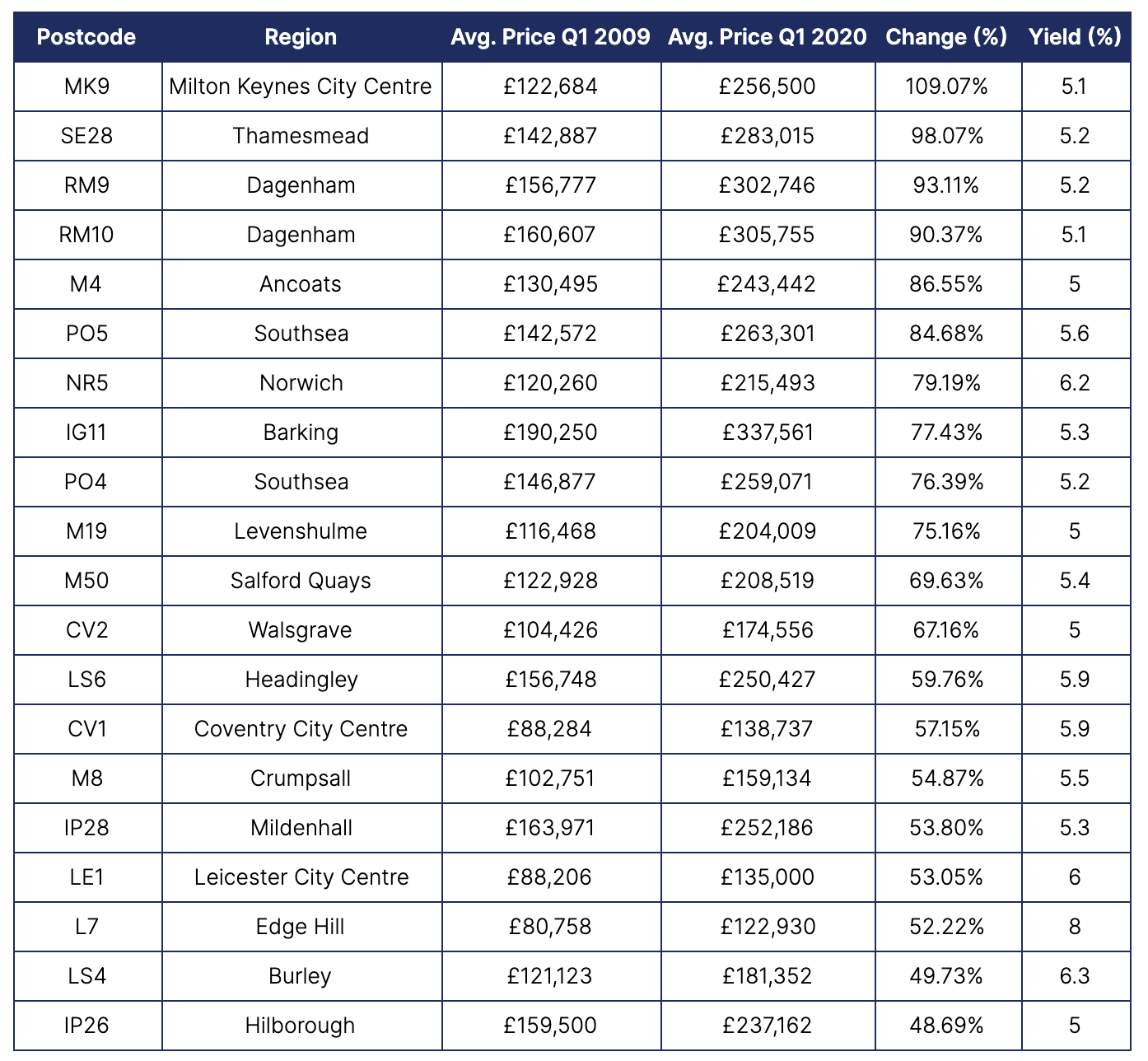

Table 3: Postcodes, with a minimum gross rental yield of 5%, ranked by capital growth

Ranked by capital growth, the top 20 postcodes with a minimum gross rental yield of 5% are:

Analysis

Where would an investor have been best off buying during the last recession?

From reviewing the data above, the absolute best place a property investor could have bought during the last recession was in London – in particular, the W11 postcode of Notting Hill in the Borough of Kensington & Chelsea.

On average, had an investor bought in W11 at the start of 2009 and then sold at the start of 2020, they would have walked away with close to £1.5m in profit.

In terms of raw cash, there are only two other postcodes in the entire dataset that saw a similar increase in average sales price: SW3 and SW7. Both are also in Kensington & Chelsea, highlighting the famous borough’s eye-watering property values.

In fact, through the lens of capital growth, the best places in the country where an investor could have bought during 2009 were mostly in the City of London – postcodes from the City makeup 75% of the top 20 biggest increases in average price (Table 1).

However, not all property investors have the funds to purchase in such high-value locations. Instead, the majority of investors are looking for deals which represent great value for money.

In order to identify where an investor would have got better value for money we can look at two things:

- Capital growth outside of London

- Gross rental yield

Table 2 shows us where an investor would have been best buying to benefit from growth in property value after the last recession, excluding London.

The results are heavily skewed towards the South East of England, with 90% of the top 20 postcodes in Table 2 within a commutable distance of the capital. The ripple effect of London’s property market is on full display here, and this is something we’ll pick up on more in the next section.

Meanwhile, if we consider rental yield as a valuable factor – which it is – then the results become much more interesting. With a minimum gross rental yield of 5% applied in Table 3, the top 20 locations a property investor could have bought in suddenly spread much further around the country.

The list is topped, perhaps somewhat surprisingly, by MK9 – covering the very centre of Milton Keynes. After this, we see a mix of areas within close proximity of London (SE28, RM9, RM10, etc) and areas in more Northern parts of the country that have witnessed huge redevelopment projects over the past 10 years (Coventry, Leeds, Leicester, Liverpool, and Manchester).

What can we learn from the results?

History has taught us that a recession leads to a drop in property values – turning a seller’s market into a buyer’s market. In the coming months, investors may have the opportunity to grab a property below market value. So what do the results of this report tell us about where they should look?

Don’t rule out high-value locations

Given London’s domination of Table 1, a key takeaway from this data is that the value potential of “premium” locations with very high average property prices was huge – far outpacing the average increase in property values during the last 11 years.

Investors may want to reconsider their stance on comparable situations in major cities like Manchester or Birmingham, where many believe the city’s most premium locations have little capital growth potential left. Our results suggest the perception that prices have already peaked in such locations may not necessarily be the case.

Especially when we consider the expected growth of the Northern economy over the next 20 years. With a slew of leading companies setting up bases in the North (HSBC, BBC, ITV, Deutsche Bank, Amazon, to name but a few so far) and waves of foreign investment in the region, it is not unreasonable to suggest we could see London-esque growth in other locations around the UK.

In short, the results highlight the return-on-investment potential of even the most expensive locations over the long term – something an investor with ample funds may want to keep in mind.

Regeneration is key

Table 1’s results aren’t just all about the strength of the fancy West London postcodes.

Looking at the performance of the East London postcodes is equally as insightful. Many areas covered by the E and SE postcodes have been regenerated in recent years, with projects driven by a demand from young professionals for accommodation close to the capital’s centre. The result is that areas like Camberwell, Clapton, New Cross, Sydenham, Walthamstow, and Walworth – all of which make it into the top 20 – have seen huge increases from what were previously quite reasonable average prices for London between 2009 and 2020.

This is a finding we also see reflected in data from Table 3. Previously dilapidated city-centre areas, which have undergone major rejuvenation and restoration projects, have benefitted immensely from such work in the past 10 years.

Coventry, Leeds, Leicester and Liverpool are all examples, as shown by the data in Table 3, but perhaps the biggest standout is Manchester.

Manchester has several entries in the top 20 of Table 3. Redevelopment schemes have propelled the city forward in the last 20 years. Ancoats (M4) is almost unrecognisable from the start of the last recession, with the area now filled with modern residential apartment blocks and scores of highly-rated cafes, bars and restaurants (in fact, the city’s only Michelin-star restaurant is based in Ancoats).

Meanwhile, the BBC’s move from London to Salford Quays (M50) was a catalyst for new jobs, infrastructure, businesses and investment in the area, now known as MediaCity. It’s worth keeping in mind that Liverpool Waters, a £5.5bn development project in Liverpool’s L3 postcode, is being built by the same people behind MediaCity.

The takeaway here is that investors should be paying close attention to undervalued, central areas in cities prime for regeneration. Right now, this means looking northwards.

There are plenty of large redevelopment projects with the potential to improve local property values throughout the Northern cities represented in Table 3, for example Birmingham’s Big City Plan, Leeds’ South Bank Project, Liverpool’s Liverpool Waters, and Manchester’s NOMA. In addition, Sheffield (which narrowly missed out on the top 20 in Table 3) is another to consider, with the city unveiling a 10-year economic plan in 2015.

The ripple effect is real

Table 2 is the perfect example of the London property market’s ripple effect. With many individuals, couples and families unable to afford to buy or rent in the capital, the demand for accommodation within close proximity rose sharply following the last recession.

In turn, and exacerbated by the low supply of affordable housing, property values in the South East have seen major increases in the past 10 years – leading postcodes in the South East to dominate the results of Table 2.

In 2020, investors can benefit by anticipating a ripple effect around other major UK cities. Areas witnessing large economic growth in the UK, such as Leeds, Liverpool, Manchester and Sheffield, will be prime candidates, so investors lacking the budget for a city-centre property could instead look to benefit from high-potential, low-cost opportunities on the outskirts of those cities.

Plus, we may now see a higher proportion of the workforce not necessarily needing to be in a city centre each day. The coronavirus lockdown has shown many that ‘working from home’ is a realistic option with benefits for both the employer (saving on office rent) and employee (better work-life balance). It remains to be seen how this will impact property demand, but one potential situation is renters and buyers who no longer need to be in the city centre could look for lower-cost options on the outskirts. The increased demand could really propel property values in those areas.

Above all else, look for investment fundamentals

Finding a balance between monthly rental income and capital growth is the key for any investment decision. Focusing solely on current rental yields will leave investors blind to the progress of a location as a whole in the past 5-10 years, whereas if we only look at capital growth we’ll miss affordable areas with high profitability.

And whilst finding a balance is difficult, the results in Table 3 prove it is possible.

All of the postcodes in Table 3, bar one (IP26), outstripped the average property price growth for the entire UK between Q1 2009 and Q1 2020 (+49.52%) whilst maintaining a rental yield of 5%+.

In fact, if a property investor in 2009 had been looking for a good balance of capital growth and rental yield, the best place in the UK they could have invested was Milton Keynes City Centre.

Milton Keynes has seen a brilliant rise in property prices since the last recession, thanks largely to a strong, service-based economy; the Centre for Cities scores it 4th in the UK for GDP per worker, whilst also ranking it 4th for business startups per 10,000 population.

Furthermore, Milton Keynes is within commutable distance of both Birmingham and London via the M1 Motorway or train – making it a great location for anyone wanting easy access to the UK’s two biggest cities.

And finally, the city has a campus for the University of Bedfordshire, where just under 14,000 students attend. The presence of students can aid local economic performance, whilst supplying a consistent flow of potential tenants for property investors.

In short, Milton Keynes has a number of the fundamentals a property investor should be on the lookout for:

- Business investment

- Employment opportunities

- Accessibility and transport infrastructure

- Flow of tenants

These fundamentals are key considerations in any property investment decision, especially when the economy is under strain – such as during a recession.

Summary

Our research has found that during the peak of the last recession, almost overwhelmingly, London was the best location in the UK where a person could have made a long-term investment in property, given the growth in property values over the following decade.

This is unlikely to come as a surprise to many, given the capital’s status as one of the world’s leading cultural and economic hubs.

However, perhaps the best-performing locations within London do offer some food for thought. Before starting this research we anticipated London would dominate, but given the results were ordered by percentage change we thought that London’s eastern suburbs would come out on top, where gentrification and regeneration have led to huge increases in property values.

Many of the city’s E and SE postcodes do appear in the top 20, but the postcode in 1st was W11, Notting Hill – a reminder that luxury property in high-value areas is a very safe choice for those who have the money and are happy to wait for the market’s growth.

The research also identified other leading postcodes where investors would have made a good return had they bought in 2009. These primarily consisted of locations within a commutable distance of London, but we saw a strong representation of Northern cities after applying a 5% gross rental yield filter.

We don’t know how the recession and ongoing coronavirus restrictions will play out over the short term, but history shows the market always recovers long-term. Therefore, by pausing to reflect on the past, we can better anticipate the future.

Whilst this research has more than exemplified London’s meteoric rise, there is good evidence we may well see similar growth in the UK’s other major cities: Birmingham and Manchester have been well-noted for their progress over the past few years, and the likes of Leeds, Liverpool and Sheffield are quickly gaining too.

For a property investor, now could be the perfect time to enter those markets. We are already seeing property developers offering excellent deals on new builds, especially off-plan – where investors are in a position of power thanks to deposit protection and the ability to see how the market plays out.

In a decade from now, it will be interesting to revisit these results and re-run the analysis. In the meantime, we hope investors will use the findings to act smartly and make sure they look back with happiness, and not regret missing an opportunity.