Welcome to this week’s edition of our Property News Roundup, where we bring you the latest insights and trends shaping the real estate landscape.

This week’s property news highlights significant developments in the housing sector. Keir Starmer’s first king’s speech will introduce mandatory housing targets and a suite of economic growth-focused bills. Additionally, UK house price inflation has accelerated, with notable regional variations, and Lloyds Bank is set to unveil a comprehensive plan to expand its influence in the rental market.

If you would like to speak to our experts for some industry insight on these important questions and discover the strategic opportunities this evolving market has to offer, reply to this article today.

Now, let’s have a look at the latest headlines that have caught our eye this week…

Property News this Week

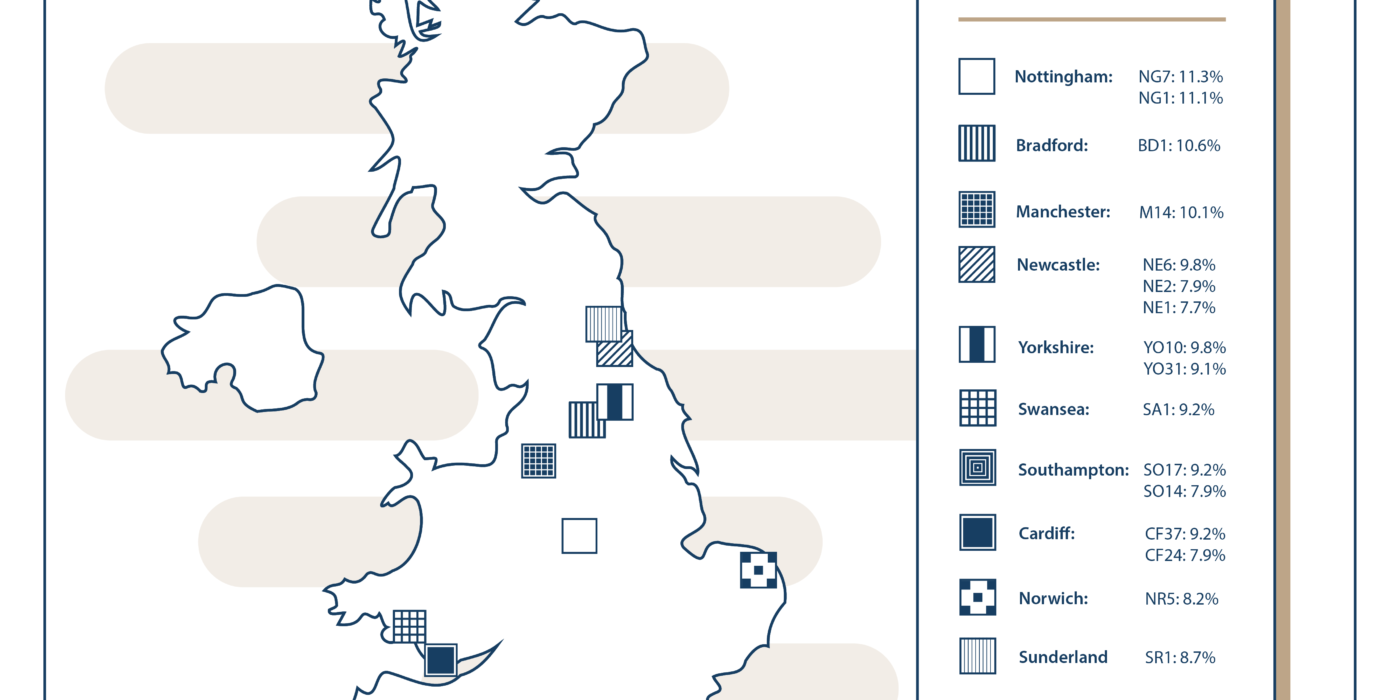

Average UK house price annual inflation was 2.2% in the 12 months to May 2024, up from an increase of 1.3% in April, according to the latest UK House Price Index from the Land Registry. The average UK house price was £285,000 in May, £6,000 higher than 12 months ago. Over the past year, average house prices have increased by 2.2% in England, 2.4% in Wales, 2.5% in Scotland, and 4.0% in Northern Ireland. Of the English regions, annual house price inflation was highest in the Yorkshire and the Humber, where prices increased by 3.9% in the 12 months to May. London was the English region with the lowest annual inflation, where prices increased by 0.2% over the year. Average prices increased by 1.2% between April and May 2024, up from an increase of 0.2% during the same period 12 months ago.

Lloyds Bank Launches Bid to Become Major Player in Rental Sector

That concludes this week’s updates. If you have any thoughts or questions about these headlines, feel free to reply—I’d love to chat with you about the latest market trends and discuss your investment goals.

I’ll be back next week with more insights on the property market. Enjoy your weekend!